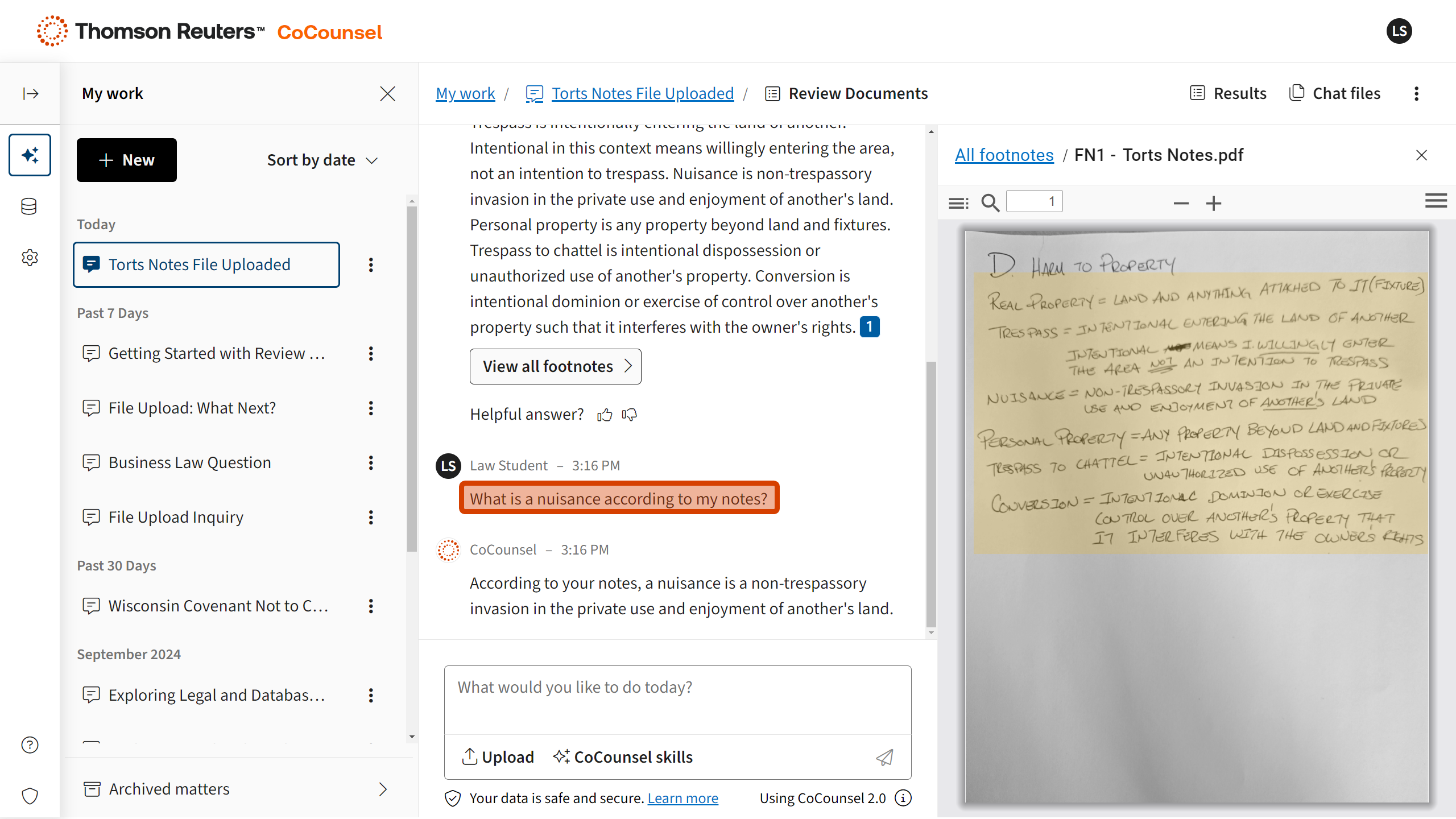

LAW SCHOOL Survival Guide

Property

Resources to help you succeed in class and on the exam.

Torts: Rules & Guides

Know the rules. Enhance your understanding.

Restatement (First) of Property

Law of

Future Interests

Identifies those laws governing the rights of persons in property when their interests are projected into the future, highlighting direct applications to ordinary situations.

Law of Easements & Licenses in Land

Clear analysis of complex legal principles of easements and licenses in land, including recent case law, court decisions, evolving and prospective issues, and transactions.

Black Letter Outlines: Property

POWERED BY QUIMBEE

13 min.

Fee Simple Estates and Future Interests

Begin learning about estates in land with this overview of fee simple estates and their corresponding future interests, specifically the fee simple absolute, fee simple determinable, and fee simple subject to condition subsequent, as well as examples of each.

POWERED BY QUIMBEE

4 min.

Case Brief Video:

In re Estate of Jackson

Rule of Law

The life tenant of a property is obligated to make all necessary repairs to maintain the property.

Jackson Issue, Holding, & Reasoning

Rule of Law

The life tenant of a property is obligated to make all necessary repairs to maintain the property.

Facts

In 1968, Mary Jackson conveyed her house to Iola Miller and Ileane Brosnan (plaintiff), but retained a life estate in it. Jackson maintained insurance for the house until her death in 1991. Shortly before Jackson died, the house was substantially damaged in a hail storm, and her insurer began to process her claim. After she died, the insurer paid the insurance proceeds to her estate. Miller (defendant), who was appointed the executrix of Jackson’s estate, split the proceeds evenly between herself and Brosnan. The estate’s attorney argued that the proceeds belonged to the estate, not the remaindermen, Miller and Brosnan. Brosnan objected, but the probate court agreed with the attorney. Brosnan appealed.

Issue

Is the life tenant of a property obligated to make all necessary repairs to maintain the property?

Holding and Reasoning (Per curiam)

Yes. Life tenants are entitled to use property in any way except that they may not injure the inheritance. This includes the obligation to maintain buildings and fences in repair from ordinary waste. If a life tenant fails to make necessary repairs, the remaindermen can bring an action against the life tenant alleging waste. In this case, the insurance proceeds passed to Jackson’s estate. Jackson had an obligation to repair the hail damage and thus her estate is responsible for making the repairs. The money should pass towards Miller and Brosnan. Accordingly, the judgment of the probate court is reversed.

Powered by Quimbee

Property: Sample Exam

30 Minutes

Fact Pattern

O is the owner of Greenacre, a single-family house on a city street. O dies, leaving the house to O’s three adult children, A, B, and C, as joint tenants with right of survivorship.

Both A and B have spouses, and each has two minor children. C is unmarried and has one minor child.

A, B, and C agree that A will live in the house. They do not discuss how long this arrangement might last. The rental value of Greenacre is $9,000 per year, but A does not pay rent to B or to C.

During the first year of A’s occupancy, A pays the property taxes on Greenacre, which are $12,000 per year. B and C each reimburse A for one-third of this amount, which means that A, B and C each pay $4,000 in property taxes. The three repeat this process during the second year of A’s occupancy.

At the end of the second year, C dies, leaving all of C’s real property to C’s child, D.

In the third year, A again pays $12,000 in property taxes. A then asks B to pay a share of the taxes. This time, B refuses to do so.

B then notifies A that B wants to move into Greenacre with B’s spouse and their two children. In response, A correctly points out that the house is not big enough for two families, but B is indifferent to this fact. After some argument, B files a partition action, naming A and D as defendants. Assume that there is no issue regarding ouster.

A answers the complaint, and alleges that B is demanding partition merely because B is angry at A. Therefore, A argues, B is acting in bad faith, which should defeat B’s attempt to obtain partition. In addition, A asserts a counterclaim against B for B’s share of the $12,000 in taxes paid by A during A’s third year of occupancy.

Upon C’s death, what interests do A, B, and D, respectively, hold in Greenacre? Explain.

Upon C’s death, A and B own Greenacre as joint tenants with right of survivorship. D has no legal interest in Greenacre, because C’s interest ceased to exist upon C’s death, and therefore no part of Greenacre passed to D.

When O died, O left Greenacre to A, B, and C as joint tenant with right of survivorship. If tenants hold jointly with right of survivorship, the death of one joint tenant automatically terminates that tenant’s interest in favor of the remaining joint tenants. Thus, a survivorship interest cannot be devised, because the interest no longer exists after the joint tenant has died.

Under the facts of this case, C’s death meant that C’s interest ended, leaving A and B as the sole owners of Greenacre. C’s death did not change the relationship between A and B, who continued to hold as joint tenants with right of survivorship. Although C left C’s real property to D, C’s estate did not include any interest in Greenacre. Thus, D did not acquire any interest in the property.

What is the most likely disposition of B’s partition claim? Explain.

The most likely result of B’s partition claim is that the court will order the sale of Greenacre, and divide the proceeds equally between A and B.

If parties own property as joint tenants, each party has an equal right to possession of the property. When the tenants cannot agree about the use of the property, any tenant may demand partition, which severs the joint tenancy and distributes the property among the tenants in equal shares.

Partition is often carried out by physically dividing the property into equal parts and giving one part to each joint tenant. This process, known as partition in kind, is the law’s preferred method of partition, because it allows each tenant to retain a share of the property. If the property cannot be physically divided, then the court may order partition by sale, which means that the property will be sold and the proceeds distributed among the joint tenants in equal shares.

In this case, partition by sale is more likely than partition in kind. Greenacre is a residential lot with a single-family house that cannot accommodate the families of both tenants. There is no realistic way to divide the house in half physically without changing its character and probably diminishing its value. Thus, this is a case in which partition by sale would be the most likely result. The court will order the parties to sell Greenacre, and A and B will divide the proceeds equally.

A has argued that partition should not be allowed because B is acting in bad faith. This will probably not affect the outcome of the case. The law sometimes imposes a duty of fair dealing among co-tenants. Usually, however, this duty is limited to situations where one co-tenant acquires part of the title from a third party, or pays off some encumbrance such as a lien or a mortgage. This duty does not extend to a co-tenant’s motivation for seeking partition, which is what A has attacked here. Moreover, under a joint tenancy, B has as much right to possess Greenacre as A does, regardless of B’s state of mind. For these reasons, the law is not likely to scrutinize B’s motive in seeking partition. Even if B is acting out of spite, this will not change the legal position of A and B in the partition action.

Is A entitled to recover any of the property tax payments from B, and if so, in what amount? Explain.

A is entitled to recover one-half of the annual property taxes from B, but only to the extent that the taxes exceed the fair rental value of Greenacre. Thus, A can recover half of $3,000 from B, or $1,500.

In general, joint tenants must pay equal shares of the taxes on their joint property. If one tenant pays more than his or her share, that tenant may bring a contribution action to recover the other tenants’ shares.

This rule is slightly different, however, if the tenant who pays the taxes has sole possession of the property. In that case, the tenant may obtain contribution, but only for taxes that exceed the fair rental value of the property.

Here, A has sole possession of Greenacre, and A has paid $12,000 in annual taxes. The fair rental value of Greenacre is $9,000 per year. Thus, A can recover on the difference, which is $3,000. Of this amount, A and B must each pay half, because they are the only two joint tenants remaining after C’s death. A can therefore obtain contribution from B for half of the $3,000 overage, or $1,500.

Yeah, we love Quimbee too.

We've partnered with Quimbee to bring you content on this page. They make law school study aids, bar prep, and CLE courses you'll actually enjoy.